How to Start a Stock Brokerage Firm in India

Everyone wants a better life, and to achieve this, people invest their money with the hope of getting better returns. The stock market is one of the most popular ways to earn higher returns over time. Because of this, many new investors are getting attracted to the stock market every day. As the number of investors increases, the demand for stock brokerage firms also grows. This makes stock brokerage a strong business idea where success and profit are both possible.

If you are interested in starting your own stock brokerage firm, it is important to understand what a brokerage firm is, how it works, what types of brokerage firms exist, and what eligibility and steps are required to start one in India. Proper knowledge and planning can help you build a profitable and long-term business in the stock market industry.

What Is a Stock Brokerage Firm

A stock brokerage firm is a company that helps investors buy and sell stocks and other financial securities in the stock market. Trading simply means buying and selling stocks, bonds, debentures, notes, and investment contracts. Individual investors cannot directly trade on stock exchanges, so they need a brokerage firm to place orders on their behalf.

A brokerage firm provides a trading platform where clients can place buy and sell orders. In return, the firm charges a brokerage or transaction fee. Apart from transaction fees, brokerage firms also earn money by charging for additional services such as advisory services, research reports, portfolio management, and margin trading.

The staff of a brokerage firm usually includes brokers, financial planners, research analysts, tax experts, compliance officers, and customer support executives. Together, they ensure smooth trading operations and proper service for clients.

Key Functions of a Brokerage Firm

One of the main functions of a brokerage firm is executing trades. The firm provides access to financial markets where clients can place orders to buy or sell securities. Completing these transactions smoothly and without errors is the responsibility of the brokerage firm.

Many brokerage firms also provide market research and analysis. This helps investors understand market trends, company performance, and investment risks before making decisions. Good research support allows clients to make informed and confident investment choices.

Another important function is asset custody. Some brokerage firms safely hold clients’ securities and assets to reduce the risk of theft or loss. Assets include cash, stocks, bonds, other securities, investments, and intellectual property like trademarks and copyrights.

Brokerage firms also offer advisory services. In these services, financial professionals guide clients on investments and portfolio management based on their financial goals and risk tolerance. Most firms also provide online trading platforms so that clients can place orders electronically from anywhere.

Some brokerage firms offer margin trading, where clients can borrow money to trade securities. This allows higher investment exposure but also increases risk, so it requires proper risk management.

Types of Stock Brokerage Firms

There are different types of brokerage firms, and each type serves a different kind of client and business model.

Full-service brokerage firms provide a wide range of financial services. These include investment advisory, research, portfolio management, and personalized support. They usually have a team of experienced financial advisors and analysts who guide clients through the investment process. Examples include ICICI Securities, HDFC Securities, and Axis Securities.

Discount brokerage firms focus mainly on executing trades at lower commission rates. They usually do not provide advisory services. These firms are popular among self-directed investors who prefer low-cost trading. Examples include Zerodha, Upstox, and 5paisa.

Online-only or digital brokerage firms operate completely through online platforms. They do not have physical branches and rely on technology to provide services efficiently at lower costs.

Currency brokerage firms focus on trading in the foreign exchange market. Institutional brokerage firms mainly serve large clients such as mutual funds, insurance companies, and other financial institutions.

Boutique brokerage firms are small firms that specialize in niche markets. They offer personalized services and focus on specific client segments.

After understanding these types, you can decide which kind of brokerage firm suits your resources, experience, and business goals.

Eligibility Criteria to Start a Brokerage Firm in India

To start a stock brokerage firm in India, certain eligibility conditions must be met. You must have at least a graduation degree from a recognized university. After graduation, a minimum of two years of work experience in a stock broking firm is required.

Your age must be at least 21 years. Training in finance, business administration, or economics is preferred to gain better knowledge of financial markets. To become a licensed stock broker, you must meet all regulatory and professional requirements set by authorities.

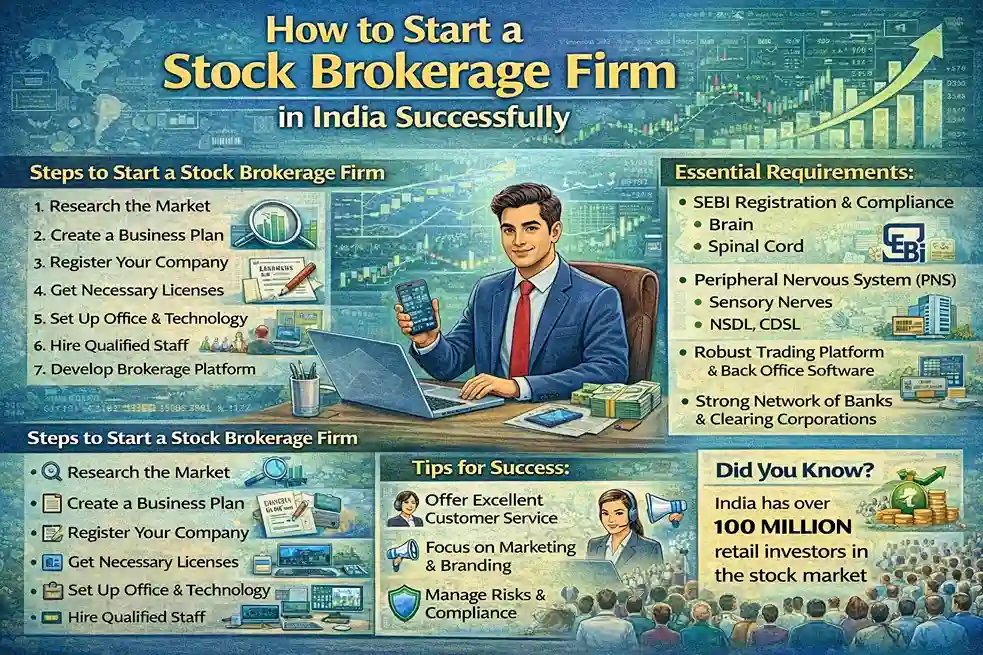

Steps to Start a Stock Brokerage Firm in India

The first step is market research and business planning. Before starting any business, market research is essential. It helps you understand competition, customer demand, and market opportunities. After proper research, prepare a business plan that includes your firm’s goals, target market, revenue model, and financial projections. You should also calculate all business costs from registration to official launch, including future requirements.

The second step is deciding the legal structure of your firm. You need to choose whether you want to start as a partnership, LLP, or private limited company. Consulting a legal expert is recommended so you can understand the advantages and disadvantages of each structure.

The third step is SEBI registration. In India, the Securities and Exchange Board of India regulates brokerage firms. You must follow all SEBI rules and guidelines. You need to apply for the required licenses and approvals and register with relevant stock exchanges like the National Stock Exchange and Bombay Stock Exchange.

The fourth step is paying the minimum base capital deposit. After SEBI approval, you must pay membership fees to the stock exchange where you plan to trade. You also need to deposit a minimum base capital as security, which usually ranges from 10 lakh to 50 lakh rupees depending on the segment.

The fifth step is investing in infrastructure and technology. A strong technology setup is necessary to support trading operations. This includes trading platforms, risk management systems, and market data feeds. You should also implement effective risk management policies to monitor and control trading risks. Staying updated with regulatory changes and market conditions is very important.

The sixth step is focusing on financial management. You need proper accounting and financial management systems to manage client funds, track income and expenses, and monitor profitability. Accurate financial control helps maintain trust and long-term stability.

The seventh step is hiring experienced staff. Qualified and experienced professionals such as traders, research analysts, compliance officers, and customer support staff are essential for making correct business decisions and achieving growth.

The eighth step is creating and implementing a marketing strategy. To attract clients, you need a strong marketing plan that includes both online and offline efforts. Building good relationships with retail and institutional investors is beneficial. Highlight your unique selling points to stand out from competitors.

Conclusion

Starting a stock brokerage firm in India can be a profitable and rewarding business if done with proper planning and patience. It is important not to rush the process. Give enough time to research, understand the market, calculate investments, and comply with all regulatory requirements. Consulting professionals before making major decisions can increase your chances of success. With the right strategy, technology, and team, a stock brokerage firm can help you earn profits while supporting investors in achieving their financial goals.